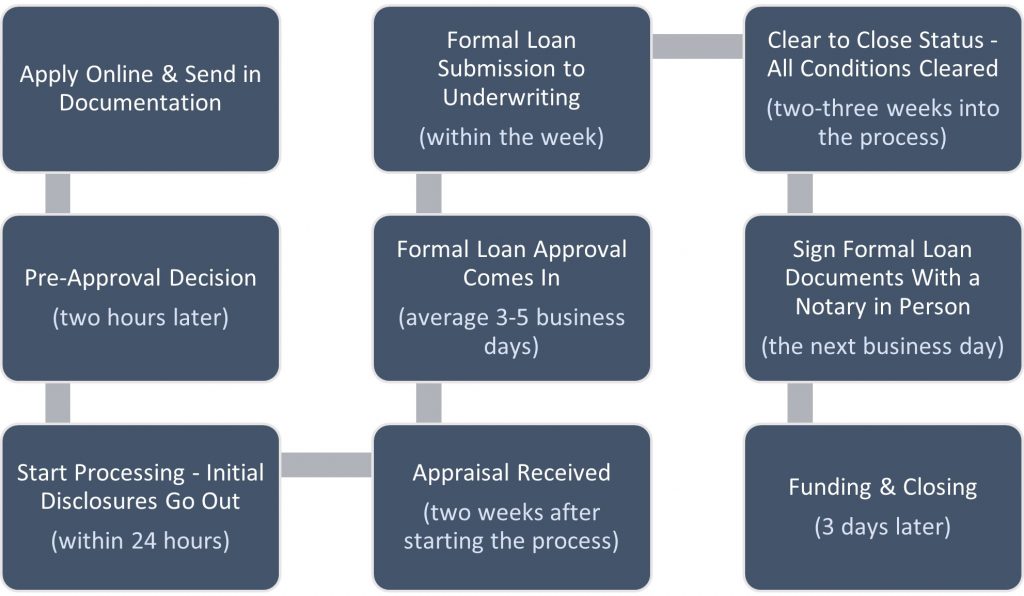

Mortgage Transaction Steps

Created On March 8, 2022 - Updated On: March 8th, 2022 by Stephanie Marrazzo

Common questions:

- Can we close in less than 30 days? Absolutely, we often close much sooner. If you were interested in a specific timeframe, just mention it to your loan consultant and we can usually accommodate you.

- Do I need an appraisal? Not always, we get appraisal waivers on about 40% of our transactions, this is likely not going to be the case for anything less than 20% equity, or if it is a newly built home.

- Will these timeframes change? Yes, these will increase and decrease depending on the economy and rates in general, but not by much. However, from start to finish, you can count on a 30-day closing.

Popular Articles

- Appraisal Not Required? Maybe Not! Find Out Before You Place an Offer to Buy a Home!

- Best Practices to Improve Your Credit Score & Interest Rate Pricing

- Can I Qualify with Self-Employment?

- Closing Cost Breakdown

- Empire of America (EOAC) – 40 Years of Residential Real Estate Lending

- HELOC Versus Cash-Out Refinance

No Comment.